Table of Contents

ToggleNH-66 Property Investment 2026: How Maha–Goa’s Fastest-Growing Highway Is Creating India’s Next Luxury Real Estate Corridor

India’s real estate landscape in 2026 is undergoing a quiet but powerful transformation. The age of speculative city-centric investing is giving way to a more disciplined, infrastructure-led approach—where highways, airports, and policy-backed corridors decide the future of land value long before it appears on mainstream radar.

At the heart of this shift lies NH-66 property investment, a theme that has moved decisively from early-stage speculation into a structured, data-backed wealth strategy.

Stretching across India’s western coastline, National Highway 66 has evolved from a scenic coastal road into a strategic economic spine. And within this spine, the Maha–Goa belt—particularly Sindhudurg—has emerged as the most underpriced, fastest-aligning luxury real estate corridor of 2026.

This blog delivers a deep, fact-based, government-policy-supported analysis of why NH-66 property investment is attracting HNIs, institutional capital, hospitality brands, and second-home buyers—and why waiting longer may mean missing the most lucrative entry window NH-66 property investment.

NH-66 in 2026: From Coastal Highway to National Economic Corridor

National Highway 66 spans more than 1,600 kilometres, connecting Mumbai, Goa, Karnataka, and Kerala along India’s western seaboard. Historically known as NH-17, the highway has been completely reclassified, redesigned, and re-prioritised under India’s national infrastructure vision NH-66 property investment.

According to the Ministry of Road Transport & Highways (MoRTH), NH-66 is now part of a broader plan to:

- Improve coastal logistics

- Strengthen tourism-driven economies

- Decongest inland freight corridors

- Enable faster inter-state mobility

Under the Bharatmala Pariyojana, the Maharashtra–Goa stretch of NH-66 has received special attention due to its high economic multiplier effect NH-66 property investment.

These upgrades include:

- Multi-lane widening

- Service roads and access-controlled stretches

- Safer tourism mobility

- Freight-friendly infrastructure

As a result, NH-66 property investment has shifted from being viewed as “coastal land buying” to a highway-led asset class, similar to what Mumbai–Pune Expressway witnessed in its early years.

Why Highway-Led Real Estate Outperforms City Assets

Real estate cycles across India show a consistent pattern:

Infrastructure creates value before population density does NH-66 property investment.

Highways:

- Reduce friction of access

- Pull economic activity outward

- Encourage land aggregation

- Enable mixed-use development

NH-66 property investment benefits from all four factors simultaneously.

Unlike saturated metro markets—where prices already reflect future expectations—NH-66 is still in the value discovery phase across many stretches, particularly in Maha–Goa NH-66 property investment.

Goa vs Maha–Goa: The Shift Investors Are Already Making

The Saturation of Core Goa

North Goa continues to attract lifestyle buyers, but from a serious investment standpoint, it faces increasing headwinds:

- Stringent CRZ regulations

- Limited new land parcels

- High entry costs

- Infrastructure stress

- Longer approval timelines

While rental yields exist, capital appreciation is flattening.

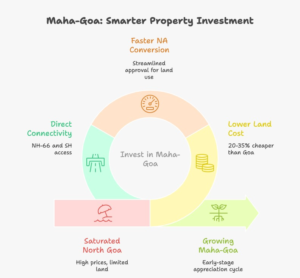

Maha–Goa: Goa’s Investible Twin

Just across the border, Maharashtra’s coastal districts—especially Sindhudurg—offer:

- Cleaner land titles

- Faster NA conversion

- Lower base prices

- More planning flexibility

- Access to the same beaches and airports

This is why NH-66 property investment activity has steadily migrated northwards into Maharashtra’s coastal belt NH-66 property investment.

Sindhudurg: The Breakout Zone Along NH-66

Sindhudurg’s rise is not accidental—it is policy-aligned and infrastructure-triggered.

Key advantages:

- Strategic location between Goa and southern Maharashtra

- Direct NH-66 access

- Emerging airport connectivity

- Tourism-friendly planning environment

India Today described Sindhudurg as:

“Goa’s quieter, cleaner, and more investible twin.”

For NH-66 property investment, Sindhudurg represents early-stage positioning with late-stage potential NH-66 property investment.

Airport-Led Growth: Chipi and MOPA Reshaping the Corridor

Chipi Airport: Sindhudurg’s Real Estate Catalyst

The operational Sindhudurg (Chipi) Airport has fundamentally changed the region’s accessibility. Travel times from Mumbai and Pune have reduced dramatically, making weekend homes and short-stay tourism viable.

According to the Airports Authority of India (AAI):

- Passenger traffic has shown steady YoY growth

- Tourism inflow has increased

- Demand for villas, resorts, and commercial spaces has surged

This has had a direct impact on NH-66 property investment, especially within a 5–15 km radius of the airport and highway.

MOPA International Airport Spillover

North Goa’s Manohar International Airport (MOPA) has created international connectivity that spills seamlessly into Maha–Goa via NH-66.

The combined effect of:

- International tourists

- Domestic second-home buyers

- Hospitality brands

has significantly strengthened the investment logic of NH-66 property investment.

2026 Government Policies Fueling NH-66 Property Investment

Maharashtra Infrastructure Push

The Maharashtra State Budget (2025–26) highlights:

- Coastal infrastructure upgrades

- Tourism-led employment zones

- Public–private participation in real estate

- Simplified approvals for planned developments

Tourism & Coastal Economy Incentives

The Maharashtra Tourism Development Corporation (MTDC) has prioritised Sindhudurg for:

- Eco-resorts

- Boutique hospitality

- Wellness tourism

- Cultural tourism circuits

These initiatives directly enhance demand along NH-66, strengthening long-term NH-66 property investment fundamentals.

Big Brands and Institutional Signals

Smart capital always enters before mass visibility.

Recent indicators in Sindhudurg include:

- ₹300+ crore luxury developments

- Boutique hotel acquisitions

- Resort chains scouting NH-66 frontage

A notable signal is Womeki Group’s ‘Eye of Goa’, reinforcing institutional confidence.

Market data platforms report:

- 22–25% land appreciation in key NH-66 pockets

- 38% rise in property enquiries post-airport operations

Such signals validate NH-66 property investment as a serious, maturing asset class.

Why Plotted Developments Dominate NH-66 Corridors

In infrastructure-led regions, land leads appreciation.

Advantages of plotted developments:

- No depreciation

- Flexible construction timelines

- Higher exit liquidity

- Custom usage (villa, rental, resale)

With rising tourism and Airbnb demand, NH-66 property investment in gated plotted developments significantly outperforms apartment-led models.

Cida De Luxora: A Strategic NH-66 Investment Case Study

Cida De Luxora exemplifies how corridor-led planning should be executed.

Location Intelligence

- 2 minutes from NH-66

- Bang on State Highway 180

- Direct beach connectivity

- Proximity to Chipi & MOPA airports

Integrated 3-in-1 Model

- Luxury villa plots

- Highway-facing retail

- Premium office spaces

This mirrors global Live–Work–Earn planning frameworks and aligns seamlessly with NH-66 property investment dynamics.

FAQ

1. Why is NH-66 property investment considered one of the best real estate opportunities in 2026?

NH-66 property investment is gaining momentum in 2026 because it is driven by government-backed infrastructure upgrades, airport connectivity, and tourism-led economic growth. Unlike speculative markets, NH-66 benefits from structured expansion under the Ministry of Road Transport & Highways (MoRTH) and the Bharatmala framework, ensuring long-term value creation. The corridor connects major economic zones across Maharashtra and Goa, making land along NH-66 increasingly scarce and valuable NH-66 property investment.

2. How does NH-66 property investment compare to investing in saturated markets like North Goa?

While North Goa remains popular, it is largely price-saturated due to CRZ restrictions, limited land availability, and higher acquisition costs. In contrast, NH-66 property investment in the Maha–Goa belt—especially Sindhudurg—offers lower entry prices, clearer land titles, faster NA conversion, and higher appreciation potential. Investors entering NH-66 corridors are still early in the value cycle, unlike Goa where prices already reflect future expectations NH-66 property investment.

3. What role do airports play in boosting NH-66 property investment returns?

Airports act as powerful demand multipliers for real estate. The operational Chipi Airport (Sindhudurg) and MOPA International Airport (Goa) have significantly reduced travel time and increased tourism inflow. NH-66 acts as the primary connector between these airports and surrounding real estate zones, directly enhancing demand for second homes, villas, hospitality assets, and commercial spaces—thereby strengthening NH-66 property investment returns NH-66 property investment.

4. Is NH-66 property investment suitable for long-term wealth creation or only short-term gains?

NH-66 property investment is best suited for long-term wealth creation. Highway-led real estate typically follows a multi-phase appreciation cycle: infrastructure build-out → demand acceleration → price consolidation. Investors who enter during the infrastructure phase—like NH-66 today—benefit from compounding appreciation over 5–10 years, rather than short-term speculative gains NH-66 property investment.

5. Why is Sindhudurg emerging as a hotspot along the NH-66 corridor?

Sindhudurg offers a rare combination of coastal beauty, infrastructure access, airport connectivity, and policy support. The district has been prioritised under Maharashtra’s tourism and coastal development plans, making it a natural beneficiary of NH-66 upgrades. Media and market reports increasingly refer to Sindhudurg as “Goa’s investible twin,” reinforcing its role in NH-66 property investment strategies NH-66 property investment.

6. What types of properties perform best under NH-66 property investment?

Historically, plotted developments and land parcels outperform apartments in highway-led corridors. NH-66 property investment in plotted developments offers:

- No depreciation

- Higher flexibility

- Better exit liquidity

- Strong Airbnb and second-home potential

Gated, NA-approved plotted communities along NH-66 are particularly attractive to both investors and end-users NH-66 property investment.

7. Are government policies supportive of NH-66 property investment in 2026?

Yes. Both central and state governments actively support infrastructure-led growth. Maharashtra’s 2025–26 budget emphasises coastal development, tourism infrastructure, and ease of doing business for planned real estate projects. These policies create a stable, transparent environment for NH-66 property investment, especially in compliant, government-approved developments NH-66 property investment.

8. How safe is NH-66 property investment from regulatory and legal risks?

NH-66 property investment is considered relatively safe when investors focus on:

- NA-approved land

- Clear land titles

- RERA-aligned developments (where applicable)

- Projects compliant with local planning authorities

Maharashtra’s regulatory framework offers greater transparency compared to many coastal markets, reducing long-term legal risks.

9. Are big brands and institutional investors actively investing along NH-66?

Yes. The presence of ₹300+ crore luxury and hospitality projects, boutique hotel chains, and branded developments indicates growing institutional confidence. Platforms like PropTiger and CRE Matrix report rising transaction volumes and enquiry growth along NH-66, validating NH-66 property investment as a maturing asset class NH-66 property investment.

10. Is 2026 the right time to enter NH-66 property investment, or is it already late?

2026 is widely considered the optimal entry window. NH-66 infrastructure is moving from execution to consolidation, but prices in Maha–Goa—especially Sindhudurg—have not yet fully priced in future demand. Investors entering now benefit from early positioning, while those waiting for complete certainty may face significantly higher acquisition costs.

Returns, Risks, and Reality

Projected Returns

Based on CAGR trends and infrastructure timelines:

- Strong capital appreciation potential

- Rental yield from tourism and commercial activity

- Liquidity supported by highway frontage

Risks and Mitigation

- Infrastructure delays → mitigated by phased investing

- Regulatory risk → mitigated by NA-approved projects

Why 2026 Is the Entry Window

Every major real estate corridor rewards those who enter before visibility peaks.

In 2026:

- NH-66 is transitioning from construction to consolidation

- Maha–Goa remains underpriced relative to potential

- Sindhudurg offers scale, serenity, and structure

- NH-66 property investment is backed by policy, infrastructure, and demand

Those who wait for certainty often pay for it in price.

Own the Corridor Before It Becomes the Coast’s Next Gold Standard

Real estate cycles reward those who move before visibility peaks.

In 2026, NH-66 property investment has entered a rare phase where:

- Government infrastructure is actively unfolding

- Airport connectivity is already operational

- Tourism demand is accelerating

- Prices in Maha–Goa are still below their long-term potential

This is the stage where informed investors quietly accumulate assets—not when billboards appear, but when fundamentals align.

The Maha–Goa belt, especially Sindhudurg, is no longer a speculative destination. It is a policy-supported, infrastructure-validated growth corridor where land, lifestyle, and liquidity converge.

If you are exploring:

- Long-term land appreciation

- A second home with income potential

- Highway-facing commercial opportunity

- A diversified real-estate portfolio aligned with future infrastructure

Then NH-66 property investment deserves a closer, on-ground evaluation.

Take the Next Strategic Step

📍 Book a Curated Site Visit

Experience the location dynamics, highway access, and micro-market potential first-hand.

📊 Request the Detailed Investment Deck

Access data on pricing, infrastructure timelines, zoning clarity, and 5-year projections.

🤝 Speak With a Corridor Specialist

Get a one-on-one consultation tailored to your investment horizon—whether you’re a land banker, HNI, or second-home buyer.

Why Act Now?

Infrastructure-led markets don’t announce their turning points—they price them in.

As NH-66 upgrades progress and tourism inflow intensifies, entry costs along this corridor are expected to rise steadily. Those who act in 2026 position themselves ahead of demand, not chasing it.

Secure Your Place in Maha–Goa’s Next Growth Chapter

NH-66 property investment is not about timing the market—it’s about understanding where infrastructure, policy, and capital are moving next.

The opportunity window is open—but it won’t stay that way for long.

👉 Book your consultation today.