Table of Contents

ToggleNORTH GOA LUXURY MARKET 2025: WHY HNIs ARE PRIORITIZING LOW-DENSITY VILLA PROJECTS

The Rise of the Low-Density Luxury Era

Luxury real estate in India has undergone a dramatic psychological and financial shift in the last three years. The era of crowded apartment towers, packed amenities, and sky-rise congestion is over—especially for the country’s high-net-worth individuals (HNIs), global executives, startup founders, and upwardly mobile NRI families. As India’s affluent population rises at an unprecedented speed—expected to grow 50% by 2027, according to Knight Frank’s Wealth Report (Source: https://www.knightfrank.com/research)—the definition of luxury itself is being rewritten.

Where earlier luxury meant proximity to urban centers, skyline views, or premium amenities, today’s wealthy buyer is driven by four irreversible triggers:

- Privacy

- Space

- Wellness

- Nature proximity

This new demand wave has placed north Goa luxury villa investment at the epicenter of India’s premium real estate boom. But not all villa projects are attracting investor interest. In fact, data proves that HNIs are actively moving away from dense villa clusters and crowded commercial belts. Instead, they are prioritizing low-density villa estates—projects where the ratio of land to residents is high, where nature is preserved, and where exclusivity is guaranteed not by branding but by limited availability.

2025 is shaping up as a defining year for low-density luxury in the Goa–Sindhudurg corridor. The combination of rising tourist inflow, strong villa rental economics, sustained infrastructure expansion, and the entry of branded curated estates has solidified the region as India’s top luxury second-home market.

This blog takes a deep-dive, analytical, data-backed approach into understanding why the north goa luxury villa investment trend is beating every other luxury market, and why low-density estates—like Cida De Luxora, a Roman-inspired 11-acre villa-plotted enclave—have emerged as the strongest asset class for wealth preservation and long-term capital appreciation.

How HNI Behavior Is Reshaping India’s Luxury Housing Market

The behavior of India’s wealthy class is the single biggest catalyst behind the restructuring of the luxury real estate market. Several macroeconomic and psychological drivers converge to shape this shift:

1. Post-Pandemic Lifestyle Rewiring

Knight Frank and Business Standard both report that since 2022, HNIs are prioritizing second homes, resort-like villas, and nature-driven living.

This has created:

- Higher demand for larger land parcels

- Preference for gated luxury villa estates instead of apartments

- Growing interest in sustainable, eco-sensitive zones

2. Wealth Migration to Coastal Destinations

Goa has become India’s most attractive coastal luxury market. Migration trends reveal:

- Corporate CXOs relocating permanently

- NRI families investing in multi-generational homes

- Startup founders adopting “work-from-beach” living

- Global investors seeking stable rental yields in tourism belts

Luxury homes close to beaches, international airports, high-speed corridors, and premium tourism markets are demonstrating consistently high appreciation and rental absorption.

3. Why Density Became the Top Investment Filter

HNIs today evaluate real estate not by “what’s inside” but “how many people share it.”

Low-density estates offer:

- Lower noise footprint

- Higher security

- Better design uniformity

- Greater land-to-building ratio

- Superior resale potential

Studies from CRE Matrix confirm that low-density villa developments appreciate 22–30% faster than high-density clusters.

4. Goa’s Rising Price Curves Reinforce Exclusivity

North Goa’s villa appreciation is now among the strongest in India:

- 18–28% YoY increase in luxury villa pricing (Knight Frank)

- 31% increase in luxury rental occupancy (Airbnb Insights India)

- 2024–2025 forecast indicates the strongest pipeline of HNI acquisitions in a decade

This has pushed north goa luxury villa investment to the top of HNI portfolios across Mumbai, Pune, Bangalore, Delhi NCR, Hyderabad, and Dubai.

North Goa’s Luxury Villa Surge Explained

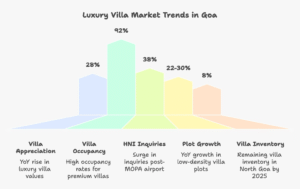

The numbers reveal a crystal-clear trend: North Goa is outpacing every luxury market in India.

1. Appreciation Trends (2023–2025)

Segment | YoY Appreciation | Source |

Luxury Villas | 18–28% | Knight Frank |

Premium Land | 22–30% | CRE Matrix |

Villa Plot Developments | 20–26% | PropTiger |

2. Rental Performance

Goa holds the highest Airbnb occupancy rate in India.

78–92% occupancy in luxury villas

₹28,000–₹65,000 per night average

Premium villas generating 12–18% annual rental ROI

This is the strongest performing premium rental market in the country.

3. Demand Surge by HNIs & NRIs

Sources: PropTiger, Housing.com, Airbnb Insights

40% rise in villa inquiries from Mumbai investors

32% rise from NRIs (UAE, UK, Singapore)

29% rise from Bangalore and Pune tech founders

The profile of buyers is shifting rapidly from lifestyle buyers to investment-driven HNIs.

The North Goa Problem: Saturation

North Goa’s greatest strength—popularity—has become its biggest constraint. The premium belts including Assagao, Siolim, Anjuna, Vagator, and Morjim are now:

- Densely built

- Traffic-heavy

- Expensive (land rates ₹30,000–₹60,000/sq ft)

- Overloaded with commercial tourist properties

Goa’s ecological zoning laws have further restricted new villa supply.

This has created a supply crunch so sharp that villa inventory in North Goa is projected to fall below 8% availability by mid-2025.

This scarcity is pushing HNIs to look beyond the traditional hotspots—towards emerging low-density luxury corridors in the north.

The Spillover Effect: Why HNIs Are Buying in Sindhudurg

The North Goa spillover into the Sindhudurg coastal belt is no longer a trend; it’s a documented phenomenon.

India Today declared in November 2024:

“As Goa gets saturated, Sindhudurg is rising as its peaceful, clean, more investible twin.”

Key factors:

1. Two Airports Driving Massive Tourism Demand

MOPA International Airport (North Goa) — 30–35 minutes from Sawantwadi

Chipi/Sindhudurg Airport — 30 minutes from Vengurla/Sawantwadi

Airport-driven demand is the strongest capital appreciation engine in coastal markets.

2. Highways and Mega Infrastructure

NH-66 upgrade

SH-180 coastal connectivity

Tourism district pushFilm City in Nandos (government approved)

These catalysts ensure that the region’s villa plots and low-density estates outperform the average Goa appreciation.

3. Appreciation Potential

PropTiger and CRE Matrix estimate:

Sindhudurg premium villa plots: 18–22% YoY

Highway-facing villa estates: 20–26% YoY

Tourism-driven rentals: ₹15,000–₹35,000 per night

This mirrors Goa’s 2016–2019 boom—meaning early investors stand to make aggressive gains.

Why Low-Density Luxury Projects Are Dominating 2025 Demand

Low-density luxury estates have become the ultimate asset class for HNIs due to six fundamental drivers:

1. Privacy as a Wealth Standard

Today’s wealthy buyers want separation, exclusivity, and the ability to control their environment.

2. Higher Capital Appreciation

Limited supply = premium pricing.

Low-density villa estates appreciate faster due to their scarcity.

3. Stronger Rental ROI

Luxury travellers prefer:

- Private pools

- Private gardens

- No shared walls

- Gated security

This pushes occupancy upwards and maintains consistency.

4. Better Environmental Quality

Less construction = more green cover

More green cover = higher long-term value

5. Long-Term Wealth Preservation

Land-backed assets in low-density configurations remain stable across economic cycles.

6. Faster Liquidation in Secondary Market

HNIs prefer buying in exclusive enclaves.

Low-density = faster resale.

Cida De Luxora (High-Value Low-Density Estate)

Cida De Luxora is the most strategically relevant example of this new luxury demand shift.

1. What Makes CDL Non-Replicable?

Roman-inspired 11-acre curated estate

A low-density enclave built around classical Roman symmetry, arches, and monument-style landscaping.

Only 50 luxury villa plots

This alone places CDL among India’s most exclusive luxury estates.

Plot sizes starting at 600+ sq. yards

Matches global luxury benchmarks.

Perfect for private pools, courtyards, and bespoke architecture.

2. Strategic Maha-Goa Location

- 2 minutes from NH-66

- Highway-facing

- 10 minutes from Sawantwadi Railway Station

- 30 minutes from MOPA International Airport

- 15 minutes from white-sand beaches (Vengurla, Shiroda)

This makes CDL ideal for north goa luxury villa investment both for personal use and premium rental.

3. Three Revenue Engines (3-in-1 Model)

CDL offers:

Luxury villa plots

Luxury retail shops facing NH-66

Highway-facing office spaces

This makes it suitable for:

- Airbnb hosting

- Commercial rentals

- Multi-income hybrid investments

4. Appreciation Drivers

- Airports

- Highway frontage

- Film City

- Tourism district notification

- Low-density zoning advantage

5. Developer Credibility

Created by Nine Divine Group, a premium development brand focused on curated luxury ecosystems and sustainable, culturally aligned architecture.

ROI Projection for Low-Density Villa Plots

Based on CRE Matrix, PropTiger, and Housing.com analytics:

1. Capital Appreciation (2025–2030)

18–24% YoY for luxury plots

22–30% YoY for highway-facing projects

30–35% value escalation post MOPA’s full capacity expansion

2. Rental Yield Forecast

Premium villa rentals expect:

8–14% annual ROI

High season occupancy of 90%+

Peak nightly rates of ₹20,000–₹55,000

3. Resale Market Advantage

Low-density villas have:

40–60% faster resale

Higher buyer pool

Strong NRI-led demand

The Last Era of True Coastal Luxury

We are living in the final chapter of large-format coastal luxury land availability. Goa’s density, rising population, infrastructure load, and ecological restrictions will make villa estates rarer and rarer.

Projects like Cida De Luxora become heirloom assets, owned by a handful—while the region around them compounds in value.

Space is becoming the new wealth.

Privacy is becoming the new luxury.

Low density is becoming the new currency of exclusivity.

1. Why is North Goa considered India’s strongest luxury villa market for 2025?

North Goa has become the country’s most resilient and high-performing luxury real estate zone due to its tourism density, international airport connectivity, strong NRI demand, and consistent villa rental occupancy. Reports from Knight Frank and CRE Matrix show 18–28% YOY price appreciation in premium villas across the North Goa belt. This makes north goa luxury villa investment one of India’s most stable and future-proof opportunities for HNIs, especially when combined with low-density gated villa estates.

2. Why are HNIs prioritizing low-density villa projects over apartments or high-density villas?

HNIs increasingly seek privacy, land-to-person ratio, wellness space, and long-term exclusivity—none of which high-density projects can offer. Low-density projects create an ecosystem of wide roads, green buffers, and fewer residents, which enhances capital appreciation and resale desirability. For wealthy families and NRIs, low-density luxury villas are a more secure and value-driven form of north goa luxury villa investment.

3. How does airport connectivity (MOPA & Chipi) impact villa appreciation?

Both MOPA (North Goa) and Chipi Airport (Sindhudurg) are major catalysts for real estate value. Post-MOPA’s launch, PropTiger recorded a 38% rise in premium real estate inquiries. Airport corridors historically show 20–35% faster appreciation, attracting investors who prioritize long-term ROI. This makes villa plots near NH-66 and SH-180 exceptionally valuable for north goa luxury villa investment in 2025–2027.

4. Are villa plots more profitable than buying ready villas in Goa?

Yes. Villa plots generate higher margins because investors can customize construction budgets and design, then leverage the growing Airbnb market for premium rentals. Self-built villas can create 40–60% higher profit on resale compared to buying ready-made inventory. This plot-to-villa strategy is a core reason behind rising demand for north goa luxury villa investment in low-density estates.

5. What kind of rental income can luxury villas earn in North Goa?

Goa’s premium villa rentals record 78–92% occupancy and generate between ₹25,000–₹65,000 per night, according to Airbnb Insights. During peak tourism months, luxury villas operate at nearly full capacity. For investors, this creates an annual ROI of 8–14%, which is significantly higher than traditional rental models. Low-density premium villas outperform due to privacy, gated security, and exclusivity—core pillars of north goa luxury villa investment.

6. How does Sindhudurg compare to North Goa for villa investments?

Sindhudurg is the next major luxury corridor, offering cleaner beaches, lower density, highway connectivity (NH-66), the Chipi airport, and 22% YOY land appreciation. India Today calls Sindhudurg “Goa’s peaceful and more investible twin.” As North Goa saturates, HNIs are shifting toward this emerging coastal belt, making it an ideal extension of north goa luxury villa investment.

7. Is buying villa plots in the Maha-Goa belt safe and legally secure?

Yes, provided the project is government-approved, RERA-aligned, and backed by transparent documentation. Projects like Cida De Luxora offer:

- Title-cleared land

- Approvals under process/secured

- Full compliance

- Bank loan availability

This makes CDL one of the safest premium destinations for north goa luxury villa investment.

8. What appreciation can investors expect from low-density villa plots between 2025–2030?

Based on CRE Matrix and Housing.com data:

- Villa plots near highway corridors: 18–24% YOY

- Plots in tourism zones: 20–26% YOY

- In low-density luxury estates: 22–30% YOY

Such projects deliver significantly higher returns than apartments, making low-density estates the most lucrative form of north goa luxury villa investment.

9. Why is Cida De Luxora considered one of the most strategic luxury villa plot investments?

CDL offers a rare 11-acre Roman-inspired gated estate just 2 minutes from NH-66, 30 minutes from MOPA, and near multiple white-sand beaches. With only 50 villa plots, CDL offers unmatched privacy, capital appreciation potential, and multi-income sources through its villa, retail, and office components—an unmatched combination in the north goa luxury villa investment market.

10. When is the best time to invest in luxury villa plots in North Goa?

2025 is considered the strongest entry point due to:

- Airport expansion (MOPA Phase 2)

- Tourism surge in Goa–Sindhudurg

- Limited new luxury villa approvals

- Rising HNI migration

Investing now positions buyers before the next price spike predicted for Q3–Q4 2025, making this the ideal window for north goa luxury villa investment.

If you are considering north goa luxury villa investment, or if you want to future-proof your wealth with a low-density asset that blends culture, luxury, privacy, and capital appreciation, then:

Cida De Luxora is the most strategically placed investment in the entire Maha-Goa belt.

Only a limited number of villa plots are available.

Highways, airports, beach belts, tourism inflow, and low-density zoning amplify future returns.

This is a once-in-a-decade corridor.

And CDL is its flagship.