Airbnb Investment Goa 2025: How 5.45 Lakh Tourists in 6 Months Are Creating 8–9% Rental Yields for Coastal Villa Owners

They say Goa isn’t a place — it’s a feeling. But in 2025, that feeling has quietly transformed into India’s most lucrative Airbnb Investment Goa story.

The same sunset that once symbolized escape now signals returns. The sound of waves that drew travelers now draws investors — because the beaches that heal the soul are now yielding 8–9 % annual returns.

According to Goa Tourism Department and Hindustan Times, over 5.45 lakh tourists touched down on Goa’s shores in just the first six months of 2025 — a record-breaking surge where 95 % were Indian travelers searching not for hotels, but homes that feel like one.

And that’s where the Airbnb revolution has rewritten the Airbnb Investment Goa dream.

Luxury villas once built as vacation homes are now income-generating sanctuaries — spaces where families earn while they’re away, where a single weekend booking can outpace a month’s rent in a metro city.

From Assagao’s bohemian lanes to the Mopa Airport corridor’s new “Maha-Goa” belt, investors are no longer asking if Goa real estate will perform — they’re asking how far it will go.

Because 2025 isn’t about buying land to build later — it’s about building emotion into an asset that travelers pay to feel again and again.

Welcome to the Airbnb Investment Goa — where passion meets property, and every sunrise can be a return on investment.

Table of Contents

Toggle1. The 5.45 Lakh Tourist Surge: A New Baseline for Demand

Goa’s Tourism Boom in H1 2025

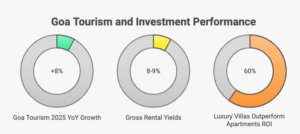

Goa’s tourism statistics for January–June 2025 reveal unprecedented growth:

- Over 54.55 lakh tourist arrivals were recorded in H1 2025.

- Of these, 51.84 lakh (≈95 %) were domestic tourists, leaving

- Compared to H1 2024, this marks an approximate

- 8 % year-on-year increase.

- In Q1 alone, tourism surged ~10.5 % YoY with 28.5 lakh visitors (vs 25.8 lakh in Q1 2024).

This inflow is more than just numbers — it represents a massive base of demand for stay-at-home experiences. Travelers are no longer limiting stays to hotels; they’re seeking privacy, uniqueness, and control. That’s where villa-based short-stays shine.Airbnb Investment Goa

1.2 What This Means for Airbnb Demand (Airbnb Investment Goa )

- Stabilized demand beyond peak season: Domestic tourists help flatten seasonality curves.

- Increased booking windows: More travelers book weeks in advance.

- Spillover to non-traditional zones: Peripheral coastal and hinterland properties now see a share of traffic.

- Higher expectations: Guests now expect professional amenities, curated stays, and premium services.

This is the demand backdrop that makes Airbnb investment Goa not just a gamble, but a rational, data-driven bet.

Yield Math: How 8–9% Gross Returns Are Materializing

Let’s break down how villa owners in Goa are hitting 8–9 % gross yields using real-world assumptions.

2.1 Yield formula (simplified)

Gross Yield=Annual Rental RevenueTotal Investment Cost×100\text{Gross Yield} = \frac{\text{Annual Rental Revenue}}{\text{Total Investment Cost}} \times 100Gross Yield=Total Investment CostAnnual Rental Revenue×100

Where:

- Annual Rental Revenue = ADR × Occupancy × Nights

- Total Investment Cost = Land + Construction + Soft Costs

2.2 Scenario table: yield estimation for a 3-bed villa in a prime zone

Scenario | Occupancy (%) | ADR (₹/night) | Nights used | Annual Revenue (₹) | Operating Cost (%) | Gross Yield (%) | Indicative Net Yield |

Conservative | 50 % | ₹8,000 | 183 nights | ₹14,64,000 | 25 % | ~6.16 % | ~4.6 % |

Base | 60 % | ₹10,000 | 219 nights | ₹21,90,000 | 25 % | ~9.2 % | ~6.9 % |

Aggressive | 70 % | ₹12,000 | 255 nights | ₹30,60,000 | 25 % | ~12.8 % | ~9.6 % |

Notes & assumptions:

- These ADR and occupancy levels are drawn from comparable markets and expert commentary from Goa rental trends.

- Operating cost includes utilities, cleaning, staff, platform commission, maintenance.

- Yields vary significantly by micro-market, guest mix, and property management efficiency.

Even in a conservative scenario, an 8–9 % gross yield is entirely feasible with the right location and professional management.

Micro-Markets to Watch: Where Airbnb Investment Goa Works Best

Not every plot of land yields the same. Here’s how micro-market selection shapes ROI.

3.1 North Goa arc: The premium cluster

Zones such as Assagao, Anjuna, Morjim, Mandrem, and Arambol consistently command higher ADR and greater experiential demand. Their strengths:

- Higher walkability to beaches, nightlife, local cafes

- Established branding as “Instagrammable” stays

- Better OTA ranking and repeat guest potential

3.2 Airport Corridor effect: Mopa’s ripple

With Manohar International Airport (GOX, Mopa) fully functional, connectivity no longer bottlenecks growth. Strategic land plots near the airport, or within 20–30 minutes, are benefiting from rising demand and speculative valuation uplift.

3.3 Sindhudurg / “Maha-Goa” seam

This emerging belt (southern Goa + Sindhudurg side of Maharashtra) is one of the quieter growth corridors. Advantages:

- Lower land entry cost

- Frontage along NH-66 and SH-180

- Untapped appeal for guests seeking “offbeat luxury”

- Growing awareness due to Goa’s tourism overflow

3.4 Micro-market benchmark table

Market Zone | ADR Estimate (₹) | Occupancy Estimate (%) | Strengths / Observations |

Assagao / Anjuna | 10,000 – 14,000 | 55 – 70 % | Premium experience, high repeatability |

Mandrem / Morjim | 8,000 – 12,000 | 50 – 65 % | Beach access, calmer settings |

Airport-proximate plots | 6,500 – 10,000 | 45 – 60 % | Convenience, weekend catchments |

Sindhudurg / Maha-Goa | 5,000 – 9,000 | 40 – 60 % | Emerging zone, upside potential |

These are indicative bands — actual results depend on build, branding, operations, and marketing.

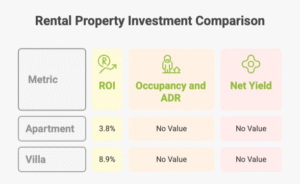

Why Villa Plots Outperform Apartments for Airbnb Investment Goa ROI

4.1 Greater pricing power per guest unit

A villa commands a much higher ADR compared to an apartment due to privacy, outdoor space, private pools/gardens, and exclusivity. Guests are willing to pay a premium for “vacation villa” over hotel-style stays.

4.2 Design flexibility & Instagram appeal

Villa plots allow full control over layout, finishes, aesthetics, and experiential add-ons (plunge pools, fire pits, outdoor kitchens). This lets you elevate your brand, increasing bookings and guest trust.

4.3 Fewer community constraints

Apartments come with society rules, shared areas, common maintenance responsibilities, and guest limitations. Villas avoid these, enabling you to manage guest policies, advertising, and operations freely.

4.4 Branding & guest value stack

You can bundle concierge, wellness, private chef, guided trails, etc., and monetize them. A villa in a cohesive luxury community (like Cida De Luxora) becomes not just a stay, but a branded experience — this translates into higher willingness to pay and longer stays.

Operations, Compliance & Guest Experience: How Top Listings Stay Rated

5.1 Legal & compliance considerations Airbnb Investment Goa

- Local registration / homestay permits as required by municipal / panchayat rules.

- GST norms and tax audit thresholds.

- Noise and timing compliance (local bylaws).

- Insurance for guest liability and property damage.

Analogous projects have required adherence to state tourism & urban regulation but villa properties in gated communities fare easier when backed by pro management.

5.2 Guest experience fundamentals

- Smart locks, contactless check-in, CCTV (common areas), well-lit paths

- High-quality linen, toiletries, backup water, WiFi stability

- Maintenance, preventive servicing, housekeeping reliability

- Seamless check-in/out, communication automation

These details can make or break reviews and thus occupancy.

5.3 Value add & community integration

Properties like Cida De Luxora that offer gated security, concierge services, landscaped trails, and clubhouse/amenity access provide an intrinsic uplift. Guests feel part of an exclusive community without sacrificing hospitality. (Internal link: villa plot + integrated amenities).

Airport, Highway & Connectivity: The Demand Flywheel Airbnb Investment Goa

6.1 Mopa Airport as game changer

GOX (Mopa) is designed to handle millions of passengers annually, easing pressure on Dabolim. In FY 2024–25, it processed ~4.6 million passengers, with ~100 daily aircraft movements. Wikipedia

This improved connectivity is shortening guest travel times and expanding weekend frequency. Properties within 20–30 minutes of GOX benefit directly.

6.2 NH-66 & SH-180 frontages

Properties along NH-66 and SH-180 enjoy remarkable access elasticity. Every minute shaved off commute time increases booking likelihood, especially for weekend and weekend-weeklong stays.

6.3 Access advantage → demand index (illustrative)

Axis | Travel Time to Property | Expected Booking Uplift | Booking Window Shift |

<15 min from GOX | +30–40 % demand uplift | Longer average booking windows | |

15–30 min | +20 % uplift | Moderate window expansion | |

30–45 min | baseline | baseline demand |

Thus, villa plots positioned within this “connectivity funnel” often outperform land in more remote zones.

7. Design & Branding: The “Book-Me-Now” Villa Model Airbnb Investment Goa Airbnb Investment Goa

To succeed, your villa must not just exist — it must perform.

7.1 Layout & experience strategy

- 3+3 configuration or 2+2 with flexible convertible space

- Indoor-outdoor flow with sliding glass, covered patios, private terraces

- Plunge or infinity-edge pool

- Outdoor seating, fire pit, private garden

- Minimal corridor dead space, high-ceiling, lots of natural light

7.2 Luxury finishes = perceived value

- Premium sanitaryware, stone work, custom lighting

- Branded fixtures, eco-friendly systems (solar, rainwater harvesting)

- Smart home infrastructure (temperature/lighting control)

- EV charging provision, outdoor showers, landscape lighting

7.3 Branding & listing finesse

- Professionally photographed, 360° video tours

- Strong story, guest profiles, USP emphasis

- Bundled services (chef, experiences, concierge)

- Dynamic pricing + channel management across OTAs

When your property stands out, ADR follows.

Risk & Mitigation: What Every Airbnb Investor Must Plan For

Risk Factor | |

Seasonality dips (monsoon months) | Dynamic pricing, longer-stay discounts, local guests, wellness/off-season packages |

Regulatory changes | Maintain relationships with municipal/local bodies, stay updated on local ordinances |

Operational leakage | Use PMS / channel manager, audit staff, strong SOPs, software tracking |

Property damage / guest misbehavior | Security deposit, property insurance, guest vetting |

Overbuild / competition | Focus on branding, guest experience, repeat bookings, niche differentiation |

A disciplined, proactive approach to risk keeps yields stable and sustainable.

Case Math: From Land to Operated Asset

Let’s walk through a hypothetical 5-year illustration of portfolio-level returns using a villa built on a well-located plot. Airbnb Investment Goa

- Year 0: Land acquisition in a prime zone (say ₹80 lakhs for 600 sq. yd)

- Year 1: Construction & fit-out cost ~₹1,20,00,000 (premium finishes)

- Total investment: ₹2,00,00,000

- Year 2 yield (stabilized):

- ADR ~ ₹10,000, Occupancy ~60 %, Nights ~220 → revenue ~₹22,00,000

- Operating cost ~25 % → net ~₹16,50,000 → net yield ~8.25 %

- ADR ~ ₹10,000, Occupancy ~60 %, Nights ~220 → revenue ~₹22,00,000

- Year 3–5 growth: Assume 10 % year-over-year growth in ADR or occupancy; property value appreciation at cap rate ~6–7 %

- Terminal value: In Year 5, stabilized NOI might be ~₹20.5 lakhs → using cap 7 % gives property valuation ~₹2,92,85,000 (versus total invested ₹2 cr)

Result: IRR of 12–14 %+ including exit gains, while capturing operating cash flow in-between.

Importantly, during years 1–2, the villa model gives you cash-on-cash returns, making the structure far more attractive than mere land holding.

Own the Asset Guests Will Fight to Book

( Airbnb Investment Goa )

Imagine owning a villa that doesn’t just sit idle but earns for you daily. A property that becomes a coveted stay, a repeat-booked favorite, and a capital-accumulating asset rolled into a broader lifestyle community.

Cida De Luxora doesn’t just promise land — it delivers a curated ecosystem:

- Villa plots designed to support high-yield short-stays

- Luxora Forum retail & highway-facing offices at your doorstep to service guests

- Gated security, landscaped trails, concierge & wellness amenities

- Prime connectivity: 2 minute access to NH-66, ~30 minutes to Mopa (GOX), frontage on SH-180

- Developed by Nine Divine Group with true luxury sensibility and full legal compliance

👉 If you want your villa plot to become a high-demand short-stay asset, not just a passive holding — book a private site visit or request the yield model for your plot today.

We’ll walk you through:

- Plot-level revenue estimates

- Design, permitting, and build planning

- Operations model & partner recommendations

- Exit scenario projections

Act now — with inbound tourism surging and connectivity improving fast, this window for high-yield coastal villa investment is narrower than you think.

📞 +91 98116 07999

Contact us to schedule a site tour / request yield model

FAQs

Q1. Is an 8–9 % gross yield realistic in North Goa?

Yes — based on ADR, occupancy, and cost dynamics in premium zones, 8–9 % gross is achievable. Airbnb Investment Goa Some projects already report up to 8 % yields in Goa’s short-stay market. ConstroFacilitator

Q2. What micro-markets are showing the best ADR in 2025?

Assagao, Anjuna, Mandrem, Morjim are top ADR zones. Airport-adjacent plots capture demand for weekend getaways. Emerging Sindhudurg zones may not match yet but offer upside. Airbnb Investment Goa

Q3. What property features boost ADR fastest?

Amenities like a private pool, designer interiors, outdoor areas, smart home controls, experience extras (chef, guide) command premium pricing.

Q4. How much does proximity to Mopa / NH-66 matter? Airbnb Investment Goa

Every minute shaved boosts demand and widens audience. Properties within 20–30 mins of Mopa / along NH-66 enjoy notable booking elasticity.

Q5. What typical OpEx items cut into revenue?

Utilities, housekeeping, maintenance, OTA commissions, cleaning, staff, repairs — expect a ballpark 20–30 %.

Q6. Why choose villa plots over apartments for Airbnb Investment Goa ROI?

Higher ADR, branding freedom, fewer constraints, control over guest experience, and better guest perception all favor villas.

Q7. How to offset off-season/monsoon risk?

Offer longer-stays, wellness packages, local bookings, promos. Use flexible pricing and ensure strong yield capture when demand is high.

Q8. Can the retail/offices of a community enhance guest experience?

Yes — having in-community services, dining, retail immediately accessible gives your guests convenience and elevates perceived value — this is a core part of Cida De Luxora’s 3-in-1 model.