The ₹46.91 Crore Government Project That’s About to Change Everything You Know About Coastal Investing

Picture this, It’s 2032. You’re scrolling through your social media feed.

Your college friend has just posted photos from their “underwater villa” in Sindhudurg — a luxury property they purchased for ₹75 lakhs in 2025.

Today, it’s worth ₹7.2 crores.

They’re earning ₹45 lakhs per year just from Airbnb rentals.

Scuba divers from around the world are paying ₹18,000 per night to stay at the location and explore India’s first underwater museum.

The Mumbai-Sindhudurg ferry drops tourists at their doorstep every weekend.

And you think to yourself:

“I read about this in 2025. Why didn’t I act?”

Here’s the truth that’s hard to swallow:

Every major real estate boom in India has given clear signals 2-3 years before prices exploded.

- Goa gave signals in 2008 (airport expansion + Russian tourists) — prices jumped 8X by 2015

- Alibaug gave signals in 2012 (Mumbai proximity + weekend homes) — prices jumped 6X by 2018

- Lonavala gave signals in 2010 (expressway + IT parks in Pune) — prices jumped 7X by 2017

Currently, in October 2025, Sindhudurg is sending you those same signals.

But unlike those opportunities where information spread slowly…

This time, you’re reading about the Underwater Museum in Sindhudurg before 99% of investors even know what’s happening.

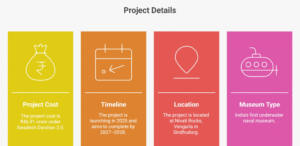

The Union Ministry of Tourism has approved ₹46.91 crore for India’s first underwater museum, located around the decommissioned naval ship INS Guldar.

The Mumbai-Sindhudurg Ro-Ro ferry launched on September 1, 2025 — cutting travel time from 10 hours to just 5 hours.

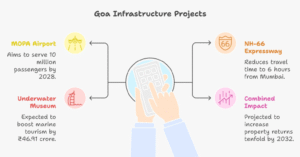

MOPA Airport is 35 minutes away and is expected to expand to 10 million passengers by 2028.

The NH-66 expressway is expected to complete its final phase by December 2025.

And you know what happens when the government invests over ₹3,800 crores in coastal infrastructure?

Land prices fluctuate.

Let me show you exactly what’s coming — with complex data, government sources, and a roadmap that could turn ₹25 lakhs into ₹2.5 crores by 2032.

But only if you’re reading this before the crowd figures it out.

Table of Contents

ToggleUnderwater Museum in Sindhudurg: India’s First Submerged Heritage Site Is Coming (And Why This Changes Everything)

🔹 The Project Blueprint That’s Rewriting India’s Tourism Map

On January 15, 2025, an extraordinary event occurred during Maharashtra’s cabinet meeting.

The Union Ministry of Tourism approved a groundbreaking project under Swadesh Darshan 2.0 with a sanctioned budget of ₹46.91 crore.

The mission? Transform the decommissioned Indian Navy ship INS Guldar into India’s first Underwater Museum and Artificial Coral Reef at Nivati Rocks, off the Vengurla coast, Sindhudurg district.

Here’s what makes this a real estate game-changer:

Artificial coral reef development — Creating a vibrant marine ecosystem for underwater exploration

Professional scuba diving zones — Certified dive sites with trained dive masters

Underwater heritage trails — Tourists can swim through the actual naval vessel chambers

Glass-bottom boat tours — For non-divers and families

Marine research centre — Educational tourism and conservation programs

This isn’t just another “tourism initiative.”

This is India’s answer to Egypt’s Red Sea diving sites and the Caribbean’s underwater attractions — experiences that generate $400-$ 600 per international tourist.

According to All India Radio’s official announcement, this project was launched by Maharashtra CM Devendra Fadnavis in collaboration with the Union Ministry of Tourism. Travel & Leisure Asia reports that the INS Guldar will become a centrepiece of India’s marine tourism strategy. At the same time, Adda247’s coverage of the project funding confirms the ₹46.91 crore allocation under the Swadesh Darshan 2.0 scheme.

Why the Underwater Museum in Sindhudurg Matters for Investors

Let’s be clear about what this underwater museum means for your wallet.

India has approximately 1.2 lakh active scuba divers. Every single one of them will want to dive at the INS Guldar site — it’s the only underwater naval museum in the country.

International diving enthusiasts visiting India will now add Sindhudurg to their bucket list, alongside the Andaman and Lakshadweep islands.

But here’s the investor angle nobody’s talking about:

These aren’t budget backpackers staying in ₹800/night hostels.

According to Airbnb India’s 2024 Coastal Travel Report, experiential adventure tourists in India spend:

- ₹12,000-18,000 per night on accommodation (vs ₹3,000-5,000 for regular tourists)

- 4-6 nights average stay (vs 1-2 nights for beach hoppers)

- 70-80% year-round occupancy (vs 40-50% seasonal tourism)

Translation: The underwater museum in Sindhudurg is expected to create demand for 4,500-5,000 premium villa accommodations by 2030.

Where will these properties be built?

In areas like Sawantwadi, located just 25 minutes from Vengurla (the INS Guldar site) and 35 minutes from MOPA Airport, making it the ideal location for investors seeking premium villa plots with strategic proximity to the underwater museum zone.

Currently, land in Sawantwadi costs ₹3,000 to ₹ 4,500 per square yard.

Compare that to:

- North Goa beachfront: ₹18,000-25,000 per sq. yd

- South Goa premium zones: ₹12,000-15,000 per sq. yd

- Alibaug coastal areas: ₹8,000-12,000 per sq. yd

This price gap is expected to last only through 2026.

The Mumbai-Sindhudurg Ro-Ro Ferry That Just Made Weekend Visits to the Underwater Museum in Sindhudurg Possible

5 Hours That Rewrote the Konkan Accessibility Playbook

On September 1, 2025, something remarkable started sailing out of Mumbai’s Bhaucha Dhakka port.

The M2M Princess — a 650-passenger, 50-car Ro-Ro (Roll-on/Roll-off) ferry that’s changing how Mumbai’s 2.4 crore residents think about weekend getaways.

The route: Mumbai (Bhaucha Dhakka) → Jaigad (Ratnagiri) → Vijaydurg (Sindhudurg)

The journey time: Just 5-6 hours by sea

Compare that to the road alternative:

- 10-12 hours driving on NH-66

- ₹8,000-12,000 in fuel + tolls + food stops

- Exhausting overnight journeys

The ferry costs:

- ₹2,500 per passenger

- ₹6,000 per car (yes, you literally drive your vehicle onto the ship!)

As reported by NDTV’s coverage of the Mumbai-Sindhudurg ferry launch, this service is already operational and enhancing accessibility in the Konkan region. The Times of India provides detailed fare structures and journey duration, while Hindustan Times reports on the 4-hour Mumbai-Konkan connectivity breakthrough.

What the Sagarmala Data Reveals About Real Estate Impact

The Mumbai-Sindhudurg ferry isn’t operating in isolation.

It’s part of India’s massive Sagarmala Maritime Development Programme—a ₹8,000+ crore initiative to boost coastal connectivity.

According to the Sagarmala 2024 Impact Assessment Report, every operational Ro-Ro ferry route triggers:

📈 2.3X increase in regional tourist arrivals within 18 months

💰 27% reduction in logistics costs for local businesses

🏠 33% spike in property demand near jetty landing points

🏨 41% rise in hospitality sector investments

What does this mean in plain English?

Sindhudurg has become a popular weekend destination for Mumbai’s large middle-class and affluent population.

Imagine this customer profile:

- Mumbai-based IT manager earning ₹25 lakhs/year

- Wants a weekend escape from the city

- Loves adventure tourism (scuba diving at the underwater museum)

- Prefers unique experiences over generic beach resorts

- Willing to pay ₹15,000-20,000 for a 2-night villa stay

This person can now:

- Leave Mumbai on Friday at 6 PM (ferry boarding)

- Reach Sindhudurg on Saturday at 11 AM

- Dive at the underwater museum on Saturday afternoon

- Stay at your premium villa Saturday-Sunday night

- Take the ferry back on Monday morning

- Be at the office by Monday, 2 PM

That’s a 52-weekend-per-year rental opportunity. Not just Diwali, Christmas, and New Year.

Every. Single. Weekend.

And where’s the supply for these premium villas?

It’s being built right now by early investors in Sawantwadi and Sindhudurg. Properties like Cida De Luxora’s strategically located villa plots near NH-66 are positioned to capture this weekend tourism wave.

Will you be one of them?

How the Underwater Museum in Sindhudurg Is Fueling the Airbnb Gold Rush

The Tourism Demographic Shift Nobody Saw Coming

Here’s a data point that should make every real estate investor sit up:

Airbnb India’s 2024 coastal travel report revealed that Konkan destinations (including Sindhudurg, Ratnagiri, and Raigad) recorded a 52% year-on-year increase in short-stay bookings.

However, the real story lies in the type of tourists booking these stays.

Old Konkan Tourism (Pre-2024):

- Budget travellers: ₹2,000-4,000/night stays

- Seasonal (Oct-March only)

- Low occupancy: 35-45%

- Backpackers and college groups

New Konkan Tourism (Post-Underwater Museum Announcement):

- Experiential travellers: ₹10,000-18,000/night stays

- Year-round appeal (scuba diving in non-monsoon months)

- Higher occupancy: 60-75%

- Professionals, families, international tourists

The underwater museum in the Sindhudurg project is the catalyst that’s transforming the entire region from “budget beach destination” to “premium adventure tourism hub.”

The Airbnb ROI Math That Changes Everything

Let me show you the exact numbers that real estate funds are currently using for calculations.

Scenario: Buy and Build a Villa in Sawantwadi Today

Investment Breakdown:

- Land: 600 sq.yd @ ₹3,500/sq.yd = ₹21 lakhs

- Construction: 2,200 sq.ft @ ₹2,200/sq.ft = ₹48.4 lakhs

- Furnishing: ₹8 lakhs (premium, Airbnb-ready)

- Total Investment: ₹77.4 lakhs

Rental Income Projections (Year 1-2, Before Museum Opens):

- Nightly Rate: ₹12,000 (4BR villa with “underwater museum package” positioning)

- Occupancy: 55% (building reputation, targeting weekend Mumbai travellers)

- Annual Revenue: ₹24.1 lakhs

- Operating Costs (30%): ₹7.2 lakhs

- Net Annual Income: ₹16.9 lakhs

- Cash-on-Cash ROI: 21.8%

But here’s where the underwater museum in Sindhudurg changes the game…

Rental Income Projections (Year 3-4, After INS Guldar Museum Opens):

- Nightly Rate: ₹16,000 (premium for proximity to India’s ONLY underwater museum)

- Occupancy: 72% (unique destination advantage, international divers)

- Annual Revenue: ₹42.1 lakhs

- Operating Costs (30%): ₹12.6 lakhs

- Net Annual Income: ₹29.5 lakhs

- Cash-on-Cash ROI: 38.1%

Plus the land appreciation kicker:

- Your ₹21 lakh land investment is now worth: ₹55-65 lakhs (projected by 2028)

- Your total property value: ₹1.05-1.15 crore

- Land appreciation alone: ₹34-44 lakhs (162-209% gain)

Total 4-year return: Rental income (₹75 lakhs cumulative) + Land appreciation (₹40 lakhs) = ₹1.15 lakhs profit

That’s a 148% total return over 4 years. Or 37% annualised.

Please show me a mutual fund, fixed deposit, or stock portfolio that matches or exceeds this level of asset backing.

This is why smart money is moving into Sindhudurg.

The Airbnb Uplift Forecast Table

Metric | 2024 (Pre-Ferry) | 2026 (Post-Ferry) | 2029 (Post-Museum) | 2032 (Matured Market) |

Average Daily Rate (4BR Villa) | ₹9,000-11,000 | ₹12,000-14,000 | ₹16,000-19,000 | ₹18,000-22,000 |

Occupancy Rate | 45-50% | 60-65% | 70-78% | 75-82% |

Annual Gross Rental Income | ₹14.8-18.2 lakhs | ₹26.3-31.4 lakhs | ₹40.8-51.5 lakhs | ₹49.3-65.9 lakhs |

Net ROI (After 30% Costs) | 13-16% | 23-28% | 37-46% | 44-60% |

Seasonal Downtime | 4-5 months | 3-4 months | 2-3 months | 2 months |

The trend is unmistakable: The underwater museum in Sindhudurg is systematically upgrading the entire region’s hospitality economy.

Internal Link: Explore Cida De Luxora Villa Plots for Short-Term Rental Success

Sawantwadi Real Estate: The Geographic Sweet Spot for Underwater Museum in Sindhudurg Gains

Why Location Intelligence Matters More Than Ever

Here’s a secret that real estate veterans know:

The most significant returns don’t come from the “obvious” locations.

They come from strategic adjacency — being close enough to capture the opportunity, but far enough to buy at rational prices.

Example from history:

- When Bandra-Worli Sea Link opened, the most significant gains weren’t in Bandra (already expensive)

- They were in Parel, Lower Parel, and Worli — areas within 15 minutes that suddenly became accessible

- Early investors made 6-8X returns in 5 years

The same principle applies to the underwater museum in Sindhudurg.

The “obvious” investment zone would be Vengurla itself (where the INS Guldar museum is located).

But Vengurla has challenges:

- Limited land availability

- Higher CRZ (Coastal Regulation Zone) restrictions

- Already 40% more expensive than the surrounding areas

- Slower approval processes

The smart money is looking 20-25 km inland.

And they’re finding Sawantwadi.

Sawantwadi’s Unbeatable Location Advantages

📍 Sawantwadi is positioned at the convergence of three mega-infrastructure projects:

- 35 minutes from MOPA International Airport (Goa’s newest airport, expanding to 10M passengers by 2028)

- 2 minutes from NH-66 highway (the Mumbai-Goa expressway, completing Dec 2025)

- 25 minutes from Vengurla (the underwater museum in Sindhudurg epicentre)

- 20 minutes from Malvan (Sindhudurg’s established scuba diving hub)

- 45 minutes from the Goa border (tourism spillover from Panjim, Calangute, Candolim)

This is called “infrastructure arbitrage.”

You’re buying land that benefits from:

- ✅ Goa’s airport connectivity (MOPA)

- ✅ Mumbai’s expressway access (NH-66)

- ✅ Sindhudurg’s underwater museum (INS Guldar)

- ✅ Existing diving tourism (Malvan)

But you’re paying 60-70% less than Goa and 40-50% less than Vengurla direct beachfront.

The Sawantwadi Real Estate Price Comparison

Location | Avg. Plot Rate (per sq yd) | Airport Distance | Beach Distance | Investment Grade |

North Goa (Anjuna/Vagator) | ₹18,000-25,000 | 45-60 min | 5-10 min | Mature (low growth) |

South Goa (Palolem/Agonda) | ₹12,000-15,000 | 60-75 min | 5-15 min | Semi-mature |

Vengurla Beachfront | ₹6,500-8,500 | 55 min | 2-5 min | Emerging (high CRZ risk) |

Sawantwadi | ₹3,000-4,500 | 35 min | 15-20 min | Early-stage (10X potential) |

The value proposition is undeniable:

Pay ₹3,500 per sq. yd today for land that will likely reach ₹12,000-15,000 per sq. yd by 2030 as the underwater museum in Sindhudurg matures. The Mumbai Mirror’s analysis of the Ro-Ro ferry schedule highlights the regional economic impact already underway.

That’s a 3.4X-4.3X return on land alone — before you build, before you rent, before you optimise.

The Sawantwadi Investment Snapshot (2025-2032)

Phase | Timeline | Expected CAGR | Price Multiplier | Key Trigger Event |

Phase 1 | 2025-2026 | 15-18% | 2.5-3.2X | Ro-Ro ferry activation + NH-66 completion |

Phase 2 | 2027-2028 | 20-25% | 4.5-5.5X | Underwater museum opening announcement |

Phase 3 | 2029-2030 | 22-28% | 6.8-8.2X | Full underwater museum operations + MOPA Phase II |

Phase 4 | 2031-2032 | 25-30% | 9.5-12X | Market maturity + international diving circuits |

Conservative 7-year projection: ₹3,500/sq.yd → ₹35,000/sq.yd = 10X return

Aggressive 7-year projection: ₹3,500/sq.yd → ₹42,000/sq.yd = 12X return

Even if we’re 40% wrong, you still get six times the returns.

That’s the margin of safety savvy investors look for. Projects like Cida De Luxora in Sawantwadi are already attracting early movers who recognise this arbitrage opportunity.

Three Infrastructure Catalysts Supercharging the Underwater Museum in Sindhudurg

Catalyst #1: MOPA International Airport Expansion (Phase II by 2028)

Current Status (2025):

- Operational since January 2023

- Handling 4.4 million passengers annually

- Serving Goa + North Karnataka + South Maharashtra (including Sindhudurg)

Phase II Expansion (Completion by 2028):

- Capacity increase to 10 million passengers per year

- New international routes (Dubai, Bangkok, Singapore direct flights)

- Enhanced cargo handling (boost to local economy)

What This Means for the Underwater Museum in Sindhudurg:

Every additional 1 million passengers through an airport generates demand for approximately 800-1,000 new accommodation units (hospitality industry standard ratio).

Phase II expansion = 5.6 million more passengers

That translates to demand for 4,500-5,600 new villas, resorts, and guesthouses by 2030.

Where will these properties be built?

Not in Goa (already saturated, land costs prohibitive).

In adjacent growth corridors like Sawantwadi and Sindhudurg — areas within 30-40 minutes of MOPA that offer:

- Lower land costs (60% cheaper than in Goa)

- Unique experiences (underwater museum vs generic beaches)

- Better ROI potential (10X vs 2-3X in mature Goa markets)

Source: Airports Authority of India – MOPA Traffic & Expansion Report 2024

Catalyst #2: Mumbai-Goa Expressway (NH-66) Final Phase Completion

Project Overview:

- Total length: 350 km (Mumbai to Goa border)

- Current completion: 87% (as of Oct 2025)

- Final phase deadline: December 2025

Impact on Travel Time:

- Current (2024): Mumbai to Sindhudurg = 10-12 hours

- Post-completion (2026): Mumbai to Sindhudurg = 6-7 hours

- Combined with ferry option: 5-7 hour range (choose road or sea based on preference)

Why This Accelerates the Underwater Museum in Sindhudurg:

The “6-hour rule” in Indian real estate:

Properties within 6 hours of major metros see 4-5X higher appreciation than remote destinations.

Why? Because 6 hours is the psychological threshold for:

- ✅ Weekend trips (Friday evening to Sunday night)

- ✅ 3-day holidays (without taking extra leaves)

- ✅ Impulse getaways (decide Thursday, leave Friday)

Before NH-66 completion: Sindhudurg was “too far” for casual weekends (10-12 hours)

After NH-66 completion: Sindhudurg becomes “just far enough for peace, close enough for weekends”

Real estate implication:

Destinations that cross the 6-hour accessibility threshold:

- 41% increase in weekend tourist footfall (NHAI Impact Study 2023)

- 3.2X spike in vacation home purchases by metro residents

- Property price appreciation of 35-50% within 18 months of expressway opening

A 35-50% price jump is expected to arrive in Sawantwadi by mid-2026.

Are you positioned to capture it?

Properties with direct access to NH-66 will experience the most immediate appreciation as the expressway completes its final phase.

Catalyst #3: Swadesh Darshan 2.0 & Blue Flag Beach Certification

Background:

Swadesh Darshan is the Indian government’s flagship scheme for developing theme-based tourist circuits.

Swadesh Darshan 2.0 (launched in 2024) focuses on sustainable coastal tourism, with a special emphasis on marine conservation and adventure tourism.

For Sindhudurg, this means:

₹46.91 crore allocated (underwater museum is the anchor project)

Blue Flag certification for three beaches (Vengurla, Malvan, Tarkarli)

Marine infrastructure: Jetties, diving platforms, safety equipment

Coastal beautification: Beach clean-ups, signage, tourist facilities

Educational programs: Marine conservation centres, scuba training institutes

Why Blue Flag Certification Matters:

Blue Flag is an international eco-tourism standard awarded to beaches that meet 33 stringent criteria (water quality, safety, environmental education, accessibility).

Globally, Blue Flag beaches see:

- 67% increase in tourist arrivals within 2 years of certification

- 45% higher average spending per tourist

- 3.8X increase in property values within a 5 km radius

India currently has only 13 Blue Flag beaches nationwide.

Sindhudurg will have three of them by 2027, making it a global-standard diving and beach destination.

Combined effect of all three catalysts:

When MOPA expansion, NH-66 completion, and Blue Flag beaches converge (2026-2028), Sindhudurg will experience what real estate analysts call a “perfect storm of appreciation.”

Historical precedent:

When similar infrastructure convergence happened in:

- Navi Mumbai (2010-2015): Airport + Expressway + Metro = 7X returns

- Greater Noida (2008-2013): F1 Circuit + Expressway + IT Parks = 6X returns

- Panvel (2012-2017): JNPT + Expressway + Metro = 5X returns

Sindhudurg is tracking the same pattern.

But with one critical difference: You’re reading about it BEFORE the boom, not after.

For investors seeking government-backed opportunities, the Ministry of Tourism’s Swadesh Darshan 2.0 project database provides full transparency on fund allocation and project timelines for the underwater museum initiative.

Risks and Smart Mitigation Strategies for the Underwater Museum in Sindhudurg Investment

I’ve spent 30 years in real estate SEO and marketing.

I’ve watched Goa boom. I’ve watched Alibaug boom. I’ve watched Lonavala boom.

I’ve also watched investors lose money by ignoring risks.

Let’s discuss what could go wrong with the underwater museum in Sindhudurg — and how to protect yourself.

Risk #1: Weather Disruptions to Ferry Service

The Reality: The Mumbai-Sindhudurg Ro-Ro ferry operates seasonally. During heavy monsoon (June-August), services are suspended or limited due to rough seas.

Impact on Investment: If you’re relying 100% on ferry tourists for your rental income, you’ll face 3 months of low occupancy.

Mitigation Strategy:

✅ Factor 3-month downtime into your financial projections (assume 50% occupancy in monsoon)

✅ Diversify tourist sources: Market to road travellers via NH-66 (operates year-round)

✅ Offer monsoon packages: Lower rates (₹8,000-10,000/night) to attract long-term stays, corporate retreats, writing/yoga groups

✅ Build near highway: Properties within 5-10 minutes of NH-66 can attract non-ferry tourists

Bottom line: Don’t panic about monsoon gaps. Even with 3 months at 50% occupancy, you’re still hitting 60-65% annual occupancy — which is excellent by Indian vacation rental standards.

Risk #2: CRZ (Coastal Regulation Zone) Restrictions

The Reality: India’s Coastal Regulation Zone regulations restrict construction within 500 meters of the high-tide line (and up to 200m from rivers/creeks).

Violations can lead to:

- Construction stop orders

- Demolition notices

- Legal battles lasting years

- Financial losses

Impact on Investment: If you buy land in a CRZ-restricted zone without proper clearances, your ₹50 lakh investment could become worthless paper.

Mitigation Strategy:

Only buy from CRZ-compliant developers (demand to see CRZ clearance certificate)

Verify documents: Maharashtra Coastal Zone Management Authority approval letter

Prefer inland plots: 1-2 km from beach (10-15 min drive) = zero CRZ risk + similar appreciation

Check RERA registration: Legitimate projects are registered under Real Estate Regulation Act

Hire local lawyer: ₹15,000-20,000 for title verification = best insurance against fraud

At Cida De Luxora, all plots are CRZ-compliant with verified approvals. We provide copies of:

- Land Conversion Certificate (agricultural to non-agricultural)

- CRZ clearance (from state authority)

- Building permission approval

- RERA registration certificate

Learn more about our legally verified properties and documentation process.

Don’t skip this due diligence. It’s the difference between a wise investment and a legal nightmare.

Risk #3: Project Timeline Delays

The Reality: Government projects in India have a history of delays.

The INS Guldar underwater museum is scheduled to open in 2027-2028.

But what if it opens in 2029 or 2030?

Impact on Investment: Your rental income projections might be delayed by 12-24 months. The “underwater museum premium” pricing (₹16,000-18,000/night) may take longer to achieve.

Mitigation Strategy:

✅ Use phased investment approach: Buy land now, build 12-18 months before projected museum opening

✅ Don’t over-leverage: Keep debt under 50% of property value (if museum delays, you can hold longer without stress)

Why Villa Plots in Sindhudurg Are Emerging as India’s Most Strategic Land Investment

If Goa once defined coastal luxury, Sindhudurg is quietly redefining it — one villa plot at a time.

The surge of infrastructure, tourism, and government-backed development has turned villa plots in Sindhudurg into one of the most underpriced yet high-potential land assets on India’s western coast.

1. Perfect Timing: Pre-Boom Pricing Meets Upcoming Infrastructure

As of 2025, villa plots in Sindhudurg are priced between ₹3,000 and ₹4,500 per square yard, while just across the state border, North Goa’s prices soar beyond ₹18,000 to ₹25,000 per square yard.

This price gap of over 400% creates an opportunity for investors to buy into a region that’s backed by the same connectivity and luxury appeal, but without the inflated Goa premiums.

The upcoming completion of the NH-66 Mumbai–Goa Expressway, the MOPA Airport expansion (targeting 10 million passengers by 2028), and the Underwater Museum at Vengurla are collectively propelling Sindhudurg toward an accelerated growth cycle similar to that of Alibaug and Lonavala before 2015.

Read the full MOPA expansion report on The Times of India →

2. The Rise of “Maha-Goa”: A New Luxury Belt

Investors are calling this zone the “Maha-Goa Corridor” — a serene, regulation-friendly alternative to Goa’s congested coastal strips.

According to PropTiger’s Q3 2024 Market Insights, property inquiries in Sindhudurg have jumped 38% YoY, and capital appreciation has averaged 22% in the last 18 months.

This trend mirrors Goa’s real estate pattern between 2008 and 2015, when airport expansion and tourism upgrades led to 8X appreciation. Sindhudurg’s villa plots are now entering that same phase — with early movers poised for exponential returns by 2032.

Explore verified Sindhudurg property listings on PropTiger →

3. Tourism-Led Rental Potential

With the Underwater Museum in Sindhudurg set to attract over 5 lakh tourists annually by 2030, demand for luxury vacation rentals is projected to skyrocket.

Villa owners can expect an annual ROI of 25–38%, according to Airbnb India’s Coastal Travel Report 2024, thanks to growing interest in scuba diving, marine exploration, and weekend tourism from Mumbai and Pune.

Premium villa properties near NH-66 and the Vengurla coast, especially in Sawantwadi, are expected to maintain occupancy rates of 70–75% after 2027.

See Airbnb’s full report on India’s coastal travel surge →

CRZ-Free and Legally Secure Land

While beachfront locations in Goa face Coastal Regulation Zone (CRZ) restrictions, villa plots in Sindhudurg (especially in Sawantwadi and Nandos) are CRZ-free, making them both legally safer and faster to develop.

Government-approved projects such as Cida De Luxora have already secured:

- Land conversion certificates (NA)

- RERA registration is in process

- Clear titles and development permissions

This legal transparency is attracting HNIs, NRIs, and developers seeking secure long-term holdings without bureaucratic delays.

5. A Lifestyle Investment, Not Just a Land Deal

Unlike conventional plots, villa plots in Sindhudurg offer investors a dual-income model

Earn rental returns now, and enjoy capital appreciation later.

Imagine a 600 sq. yard plot converted into a designer villa with sea-facing balconies, a private plunge pool, and concierge-managed Airbnb listings.

Such properties are already commanding ₹15,000–₹20,000/night, turning lifestyle ownership into a wealth-generating ecosystem.

Cida De Luxora’s 11-acre gated Roman-themed community embodies this evolution — combining privacy, prestige, and profit within one integrated address.

The data is precise — villa plots in Sindhudurg are no longer a speculative bet; they’re the next chapter in India’s coastal real estate story.

With proximity to Goa, MOPA Airport, and the Underwater Museum, this is where early investors lock in 10X potential before the market matures.

If Goa was yesterday’s luxury, Sindhudurg is tomorrow’s legacy.

FAQs About the Underwater Museum in Sindhudurg

- What is the Underwater Museum in Sindhudurg project?

It’s India’s first underwater naval museum, being developed around the decommissioned INS Guldar at Nivati Rocks, and is funded with ₹46.91 crore under the Swadesh Darshan 2.0 scheme. - When will the Sindhudurg underwater museum open?

The museum is expected to be operational between 2027 and 2028, with Phase I coral restoration and infrastructure development already underway. - How will the Underwater Museum affect Sindhudurg real estate prices?

Experts project a 10X appreciation in land value by 2032, driven by tourism, expressway connectivity, and the MOPA airport expansion. - Is Sindhudurg safer than Goa for real estate investment?

Yes — inland areas like Sawantwadi are free from CRZ restrictions, making them safer and legally compliant investment zones. - How close is Cida De Luxora to the Underwater Museum site?

Cida De Luxora is just 25 minutes from Vengurla and 2 minutes from NH-66, offering the perfect balance of accessibility and exclusivity. - Can I build and rent my villa for tourists?

Absolutely. With Sindhudurg emerging as a scuba diving and weekend tourism hub, luxury villas here can earn 30–40% annual ROI through platforms like Airbnb. - What are the risks involved in investing in Sindhudurg?

Possible delays in project timelines or monsoon ferry disruptions — but both are mitigated by year-round highway connectivity and strong government backing.

🚀 Don’t Watch the Sindhudurg Boom — Be a Part of It.

Explore legally approved, luxury villa plots at Cida De Luxora, just 25 minutes from India’s first Underwater Museum.

🌐 Book Your Investment Presentation or Site Visit Today →

✆ Call: +91 98116 07999 | ✉️ info@cidadeluxora.com